Automatic enrolment is a continuing process for employers – it doesn’t end once you’ve put your staff into a workplace pension. Employers have ongoing responsibilities that they need to complete, and to stay compliant you will have to:

- assess the age and earnings of staff who aren’t enrolled in a workplace pension each time you pay them, to see if they need to be put into one

- work out how much money you need to pay into your staff’s scheme every time you pay them

- continue to make the payments that are due into the scheme every time you run payroll

- write to staff to let them know what’s happening

- keep records relating to your workplace pension scheme

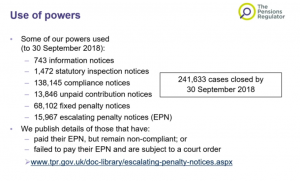

Enforcement teams have also been conducting spot checks around the country – so employers should make sure they’re staying on top of their legal duties as we may pay them a visit. Below are details of some of the powers used.